From Migration Surge to Deportation Shock: The Multifamily Outlook for 2026

From 2021 through 2024, U.S. multifamily fundamentals were propped up by an abnormal demographic tailwind: a post-COVID migration surge.

In 2023 alone, the U.S. population grew by roughly 4.4 million people—far above historical norms. And between 2021 and 2023, the number of unauthorized immigrants living in the United States grew from an estimated 10.5 million to 14 million, according to a new Pew Research Center report. That translated into an accelerated renter demand.

This surge created an artificial occupancy floor, particularly in Class B and Class C workforce housing. Despite rising rents, worsening affordability, and localized oversupply, vacancies stayed lower than expected. Many operators pointed to “strong fundamentals.” In reality, population growth was doing the heavy lifting.

That support is now fading.

In 2025, U.S. immigration policy shifted decisively toward enforcement. The expansion of expedited removal now applies to individuals unable to prove two years of U.S. residency. This is a clear break from the conditions that fueled rental absorption over the last cycle.

For owners and operators, the implication is direct: renter demand is taking a hit. Deportations—and just as importantly, self-deportations—introduce the risk of sudden lease loss. The exposure is highest in workforce housing, where immigrant households are more heavily represented.

This does not signal a collapse in occupancy. It does, however, remove the demographic buffer that masked underlying softness in certain markets.

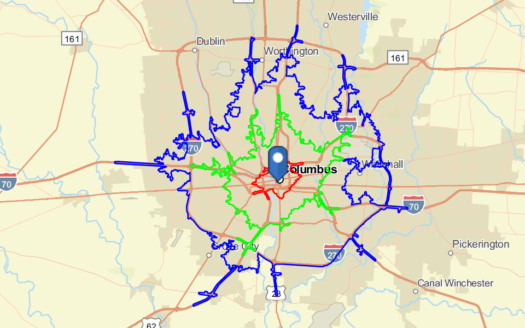

My 2026 Outlook — Columbus, Ohio

From an operator and brokerage standpoint, here’s how I see 2026 shaping up locally:

- Demand remains intact, supported by a resilient regional economy, but growth is moderating in line with national trends.

- The supply wave has peaked. The final major tranche of new deliveries hit in December 2025.

- Vacancy is elevated, sitting at roughly a two-decade high, but should begin easing as supply pressure subsides.

- Rent growth is flat today, with a gradual return expected toward the back half of 2026 as absorption catches up.