Columbus Multifamily Vacancy At 20-Year High: Q4 2025 Market Analysis

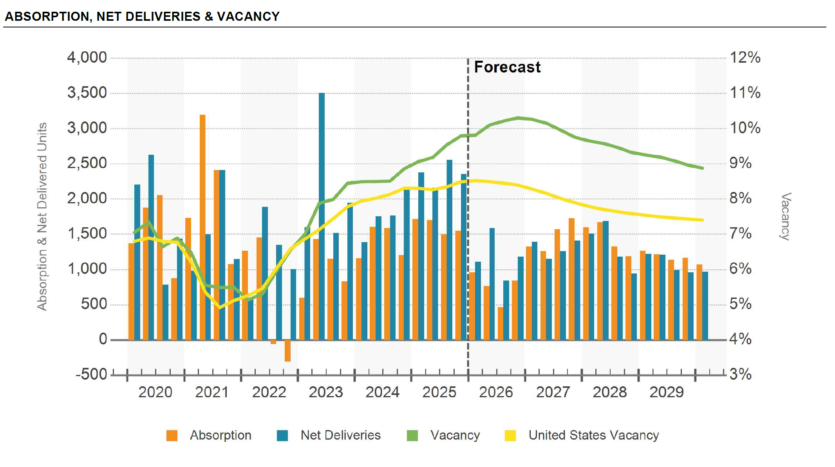

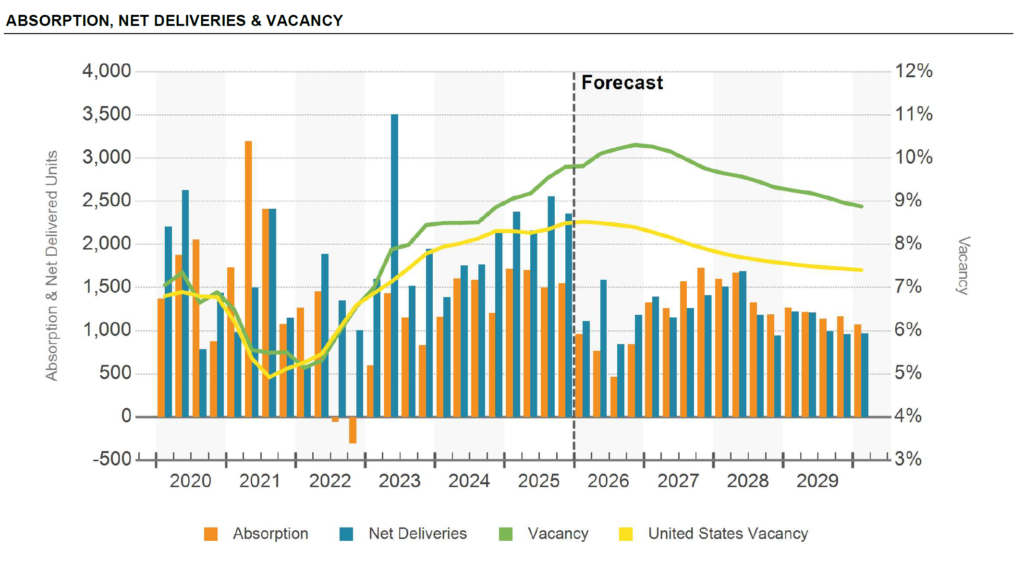

This last quarter of 2025 tells a similar story to Q3. Columbus is navigating a record-shattering wave of new supply that has pushed vacancy rates to a two-decade high. Even with demand significantly outperforming historical norms, the sheer volume of units hitting the market has effectively flattened rent growth across the region. As we look toward 2026, the sharp pullback in the construction pipeline suggests a period of stabilization is approaching, but not until the end of the year. For now, operators are competing by offering concessions and lowering rents to maintain occupancy.

The market reached its peak delivery phase in the final quarter of 2025, resulting in the softest rent growth seen in over ten years. While net absorption remains healthy—nearly double the historical average—it simply cannot keep pace with the 9,093 units delivered over the last 12 months. This supply-side pressure is most visible in the suburban submarkets and the 3-star segment, where vacancy has touched all-time highs.

Market Annual Trends

(Historical = 10-year trailing average | Forecast = upcoming 12-month)

- The Columbus vacancy rate remains at its highest level in more than 20 years, currently at 9.8%, which is 150 basis points above the national benchmark.

- Net absorption over the last 12 months totaled 6,286 units, significantly above the historical average of 3,180 units.

- The market saw 9,093 units delivered over the past year, far exceeding the 10-year historical average of 3,848 units.

- Delivered Units: 9,093 | Historical Avg: 3,848 | Forecast: 5,156 | Peak: 9,436 (2025 Q4).

- Annual asking rent growth has decelerated to 0.2%, marking the weakest performance for the market in a decade.

- The construction pipeline has dipped to a four-year low, representing a 75% pullback in supply expected for 2026.

- Delaware County continues to lead the region, accounting for 20% of 12-month deliveries and 26% of market-wide net absorption.

Class-Specific Rent Growth (12-Month):

- 4 & 5 Star: -0.3%.

- 3 Star: 0%.

- 1 & 2 Star: 2.6%.

Capital Markets Overview

- The total asset value for the Columbus multifamily market is now estimated at $34.5B.

- Total sales volume over the last 12 months reached $598.7M, supported by 117 transactions.

- Market cap rates have expanded to 6.7%, up from 6.27% one year ago.

- Transaction volume in the first nine months of 2025 nearly doubled the totals from the prior year.

- Private buyers continue to dominate activity, representing approximately 60% of the sales volume over the past 12 months.

- Institutional buyers have pulled back, accounting for 23% of the buyer pool compared to their five-year average of 33%.

- Owner-users have stepped in to fill the gap, representing 19% of the buyer pool, a massive jump from their 3% historical average.

Class-Specific Capital Metrics:

- 4 & 5 Star: Market Cap Rate 6.2% | Market Sale Price/Unit $194,990.

- 3 Star: Market Cap Rate 6.6% | Market Sale Price/Unit $144,279.

- 1 & 2 Star: Market Cap Rate 7.2% | Market Sale Price/Unit $94,756.

Takeaways

When comparing Q4 to our previous Q3 analysis, the most notable trend is the final realization of the 2025 supply peak. While the vacancy rate is officially 9.8%, it is important to note the quarter-over-quarter increase of 50 basis points, which indicates that the market is still searching for its floor. Investors are clearly shifting toward value-add plays in the 1 & 2-star space, which is the only segment maintaining strong rent growth at 2.6%. The 75% projected drop in 2026 deliveries is the “light at the end of the tunnel” that should allow vacancy to compress once this current wave is absorbed.

A critical factor for the final weeks of 2025 is the shifting demographic landscape. Beyond the standard economic cycles, we are seeing the impact of significant changes in migration. After a period of rapid population growth, recent federal policy shifts have led to a sharp increase in deportations and voluntary emigration. According to the Pew Research Center, the immigrant population in the U.S. began a notable decline in 2025, which could impact the secondary migration that Columbus has historically relied on for demand. For a market that just added over 9,000 units, any dip in new household formation will extend the time needed to stabilize these new assets.

Data Source: CoStar Group