What Columbus’ Urban Core Tells Us About Multifamily Demand

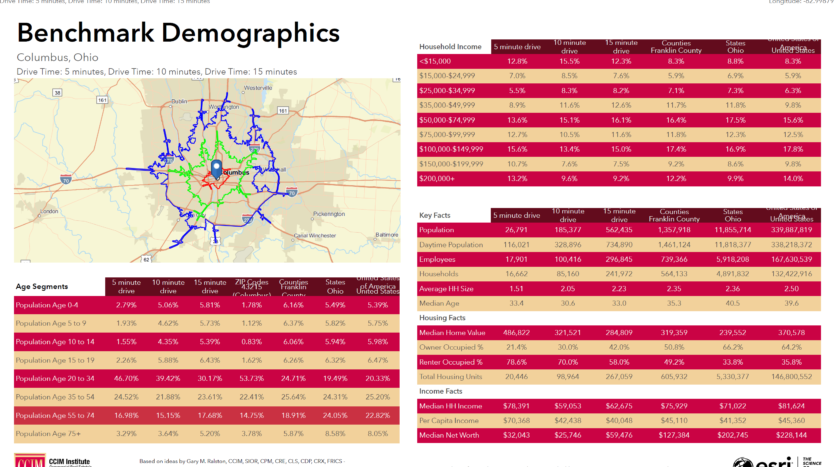

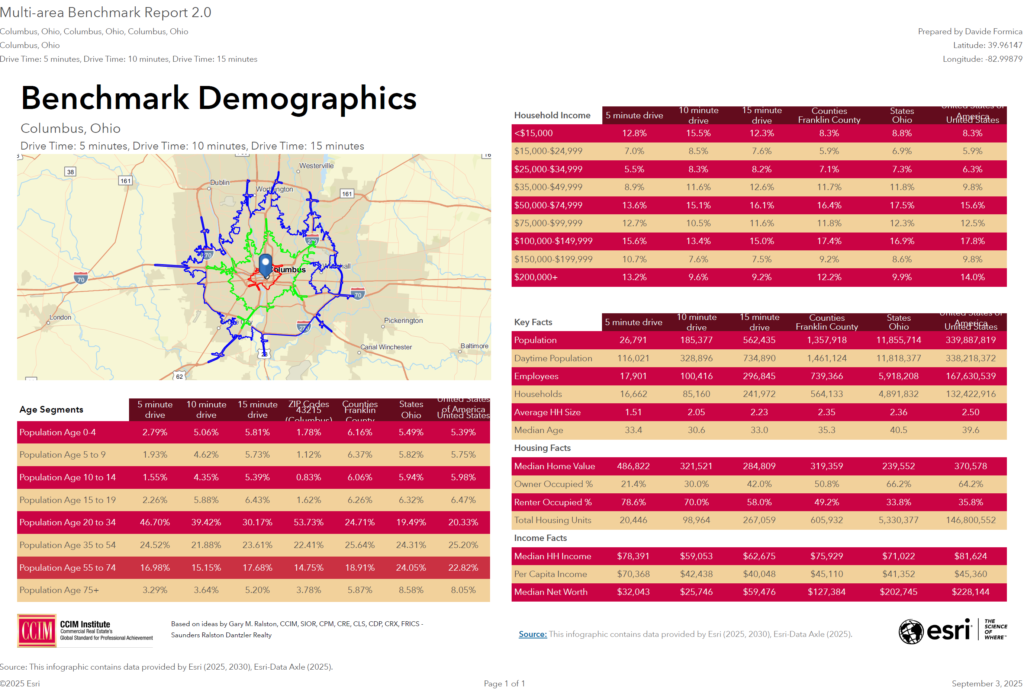

Columbus, Ohio continues to show strong fundamentals for real estate investors targeting income-diverse, high-demand rental zones. The latest benchmark with data provided by Esri (2025) reveals critical demographic and income segmentation patterns within 5, 10, and 15-minute drive times from downtown Columbus.

High Rentership Near Urban Core

Within a 5-minute drive from downtown Columbus, over 78% of housing units are renter-occupied. Even expanding out to the 10-minute mark, renters make up 70% of the housing stock. These concentrations are significantly above state (33.8%) and national (35.8%) averages, pointing to a renter-heavy corridor not just by design, but by necessity.

Much of this rentership stems from the younger, working-age demographic dominating the area. Ages 20 to 34 make up 46.7% of the 5-minute drive population and over 39% within 10 minutes — a sharp contrast to Ohio’s 19.4% in this range. Many in this group are early-career professionals or students priced out of ownership, yet they still seek proximity to jobs and amenities.

Income Spread Reveals Hidden Affordability Constraints

Despite a median household income of $78,391 in the 5-minute zone, over 20% of households earn below $25,000, indicating a wide economic gap. Median home values here are approaching $487,000, far out of reach for most of the workforce unless substantial subsidies or generational wealth are involved.

This mismatch between income and home values reinforces the case for B and C class multifamily, workforce housing, or creative mixed-use product types. It also signals that much of the urban core’s rental activity is not purely preference-based — it’s economically driven.

Strategic Takeaways

• Focus on rent-by-necessity product types near downtown. There’s an affordability wall that homeownership can’t cross in these zones.

• Target 10–15 minute drive areas for housing that bridges the gap. These regions show decreasing rentership (58% at 15 min) and lower median home values (~$285K), creating potential entry points for build-to-rent.

• Prioritize efficient floor plans for one-person households. The average household size near downtown is just 1.51 people per household, which supports micro-units, studios, or co-living arrangements in infill developments.

Conclusion

Columbus has a renter-heavy core with demand concentrated among young, income-diverse renters who need practical housing located in higher-density areas closer to downtown.