Multifamily Market Analysis – Columbus, Ohio – Q2 2025

The Columbus multifamily market saw continued strong demand in Q2 2025 with net absorption significantly above historical averages. However, record-level new deliveries pushed vacancy to its highest level in over two decades. Investment activity remained steady, with institutional capital representing a larger share of buyers and several notable high-value transactions closing during the quarter.

Market Annual Trends

- Delivered Units: 7,975 | Historical Avg: 3,702 | Forecast: 4,513 | Peak: 8,488

- Net Absorption: 6,123 | Historical Avg: 3,123 | Forecast: 4,371 | Peak: 8,540

- Vacancy Rate: 8.8% | Historical Avg: 7.0% | Forecast: 8.4% | Peak: 10.3% (2003 Q4)

- Asking Rent Growth: 2.2% | Historical Avg: 2.1% | Forecast: 2.7% | Peak: 7.6% (2022 Q2)

- Effective Rent Growth: 1.9% | Historical Avg: 2.1% | Forecast: 2.7% | Peak: 8.0% (2022 Q2)

- Average Asking Rent: $1,378 market-wide; $1,665 for 4 & 5-Star units, $1,392 for 3-Star units

- 3-Star Units: Vacancy reached 9.1% (highest in nearly 20 years); deliveries totaled 4,700 units, nearly triple pre-pandemic levels

- 4 & 5-Star Units: Vacancy declined 120 basis points to 9.4%, with 3,300 units delivered

- Under Construction: 8,976 units, representing 4.0% of inventory

- Key Development Areas: Delaware County accounted for 31% of units delivered; Downtown Columbus contributed 17%, and Upper Arlington 15%

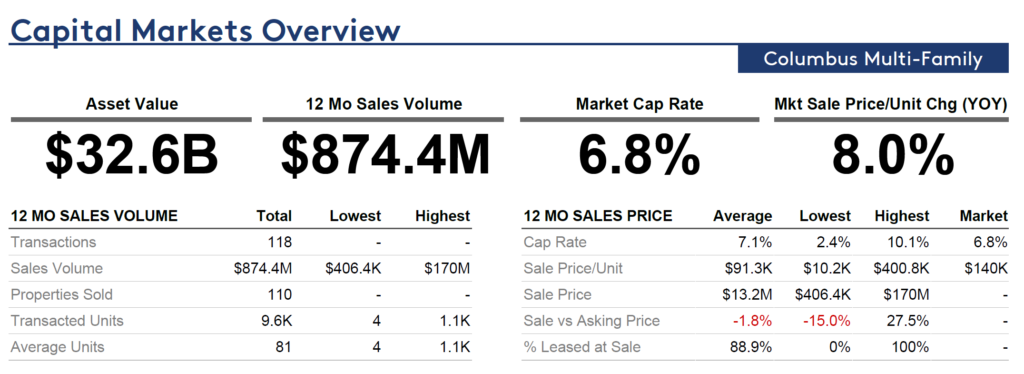

Capital Markets Overview

- Total Asset Value: $32.6 billion

- 12-Month Sales Volume: $874.4 million

- Market Cap Rate: 6.8%

- Average Sale Price/Unit: $140,000

- Total Transactions: 118, involving 110 properties and 9,600 units

- Institutional Capital: Comprised 40% of the buyer pool, up from the 3-year average of 23%

- Top Sale: The Gardens sold for $170 million (1,064 units), marking a record price for Columbus

- Other Notable Transactions:

- Gravity 2.0 project traded for $78 million

- The Bradford at Easton sold for $61 million ($188,200/unit)

- Central Park Apartments sold for $57 million ($177,700/unit)

- Submarket Highlights:

- Northeast Columbus: $394.3M sales volume, 6.3% cap rate, $137,796/unit

- Downtown Columbus: $181.2M sales volume, 6.2% cap rate, $227,427/unit

- Upper Arlington: $97.1M sales volume, 6.9% cap rate, $152,172/unit

Takeaways

Compared to Q1 2025, Q2 saw a continued rise in vacancy as new supply outpaced demand. While absorption levels remained strong, the influx of deliveries further pressured occupancy rates. Investment activity strengthened quarter-over-quarter, driven by increased institutional participation and several record-setting sales. The market’s long-term fundamentals remain supported by strong demand drivers, though elevated vacancy may persist as additional units are delivered through the remainder of the year.

Data Source: Costar Group